Italy’s rich history, stunning landscapes, and vibrant culture make it an attractive destination for Canadian citizens looking to buy a property. Whether you’re searching for a vacation home, a retirement haven, or a safe investment, understanding the rules of purchasing real estate in Italy is crucial.

This guide addresses the top frequently asked questions (FAQs) to help Canadian buyers in navigating the Italian property market, incorporating the latest legislative updates.

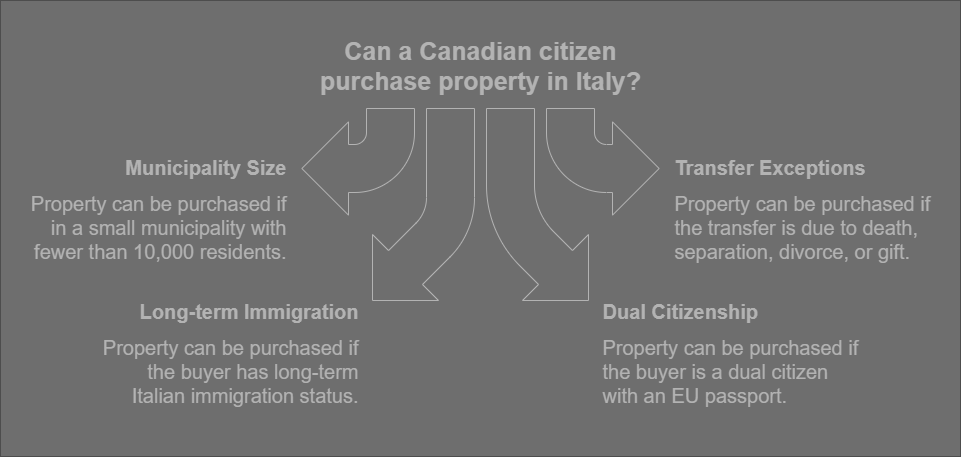

1. Can Canadian citizens legally purchase property in Italy?

Yes, Canadian citizens can legally purchase property in Italy, but restrictions now apply as a result of reciprocity with Canada’s “Prohibition on the Purchase of Residential Property by Non-Canadians Act,” effective January 1, 2023. These restrictions align with the limitations Canada imposes on foreign buyers. However, Canadian citizens may still qualify to buy property if they meet specific exceptions.

2. What are the exceptions that allow Canadians to buy property in Italy?

Canadian citizens must meet at least one of the following exceptions to purchase property in Italy:

- The property is located in a municipality (“Comune”) with fewer than 10,000 residents, unless near a major metropolitan area, where restrictions may apply.

- The purchase involves transfers by death, separation, divorce, or gift, which are not subject to the ban.

- The buyer holds long-term Italian immigration status.

- The buyer is a dual citizen holding an EU passport in addition to Canadian citizenship.

- The buyer is purchasing the property with a spouse or civil union partner who is an EU citizen or an Italian permanent resident.

If none of these exceptions apply, purchasing residential property in Italy may be restricted.

3. Where can Canadians buy property in Italy?

Canadian citizens can purchase property in municipalities (“Comuni”) with fewer than 10,000 residents. However, restrictions may still apply if the property is located near a major metropolitan area. It’s essential to confirm the location’s eligibility with a real estate professional before proceeding.

4. How does the property purchase process work in Italy?

Buying a property in Italy is a highly regulated and formal process, with distinct contractual standards and negotiation practices. It typically involves:

- Offer and Acceptance: A formal and binding agreement between buyer and seller.

- Preliminary Contract (“Compromesso”): A more detailes binding contract outlining all terms of sale.

- Final Deed (“Atto/Rogito Notarile”): Signed in front of an Italian Notary, at which point the balance of the payment is made, the keys are handed over, and the deed is registered in the Public/Land Registry.

For a detailed step-by-step guide, visit our Buying Guide to learn everything you need to know about purchasing a property in Italy.

5. Are there residency requirements for Canadian property owners in Italy?

Owning property in Italy does not automatically grant residency. Canadian citizens can stay in Italy for up to 90 days within a 180-day period without a visa. For longer stays, a visa or residency permit is required. Common options include:

- Elective Residency Visa: Ideal for retirees looking to enjoy the Italian lifestyle full-time.

- Work or Study Visa: For individuals relocating to Italy for employment or education.

If you’re a remote worker, Italy’s Digital Nomad Visa offers an exciting opportunity to live and work in the country while enjoying its breathtaking scenery. Learn more in our blog: Italy’s New Digital Nomad Visa: A Gateway to La Dolce Vita.

6. What financing options are available for Canadian buyers?

Canadian buyers have several financing options:

- Italian Mortgages: Some Italian banks offer mortgages to non-residents, though terms may be more stringent and may require a higher down payment. Understanding the local mortgage system is crucial, and working with an experienced broker can make the process smoother. To dive deeper into the process, read our blog: Getting a Mortgage in Italy: A Comprehensive Guide.

- Canadian Financing: Buyers can secure financing through Canadian lenders, such as home equity loans or cross-border mortgage services.

- Currency Exchange Considerations: Exchange rate fluctuations can impact the cost of purchasing and maintaining a property. Working with a reputable currency exchange provider can help secure favorable rates and reduce financial risks.

Conclusion

Buying property in Italy as a Canadian citizen is an exciting and rewarding venture, offering you the chance to enjoy “la dolce vita” in one of the world’s most beautiful countries. Liguria, often referred to as the Italian Riviera, stands out as an exceptional destination for property investment.

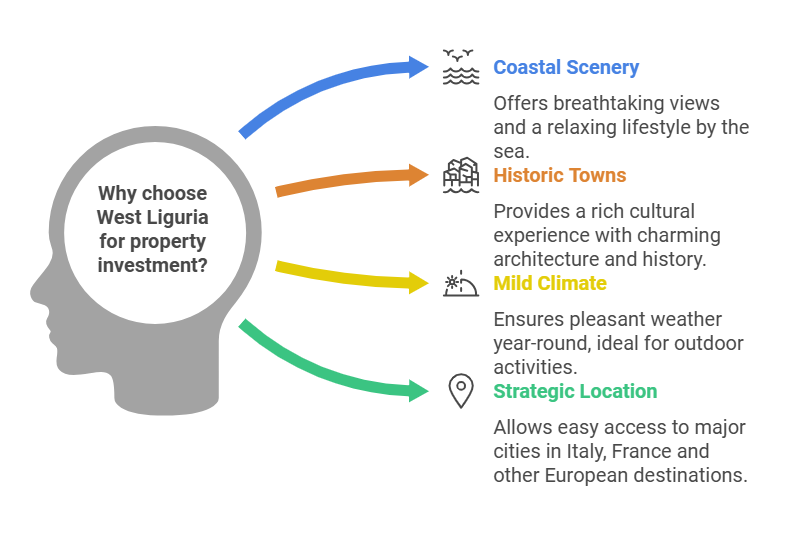

Why choose West Liguria?

West Liguria offers a unique combination of stunning coastal scenery, historic towns, and a mild Mediterranean climate. The region is home to glamorous seaside towns such as Sanremo and Bordighera, and charming inland areas dotted with olive groves and vineyards. Its strategic location, bordering France, allows easy access to Monaco, the French Riviera, and major European cities.

The region is conveniently located near Nice International Airport (NCE), which provides direct flights to Canada, making it an ideal choice for Canadians seeking easy connectivity between their homes in Italy and North America.

For those seeking a second home, retirement haven, or investment property, West Liguria provides excellent options, from luxurious villas with sea views to quaint townhouses and modern apartments. Its culinary delights, vibrant culture, and strong community make it a perfect destination to call home.

With decades of experience in Liguria’s real estate market, LiguriaHomes Casamare is your trusted partner in finding the perfect property in Liguria. Our expertise, local knowledge, and personalized service ensure a smooth and stress-free buying experience.

Start your journey today by exploring our listings or contacting our team for tailored advice. Let us help you make your dream of owning property in Italy a reality!

LiguriaHomes Casamare

Here is a recent Google review from one of our Canadian clients who recently completed the purchase of a property in Ospedaletti, Liguria:

“We are a couple from Toronto, Canada, and recently had the pleasure of working with Pavel Korovin from LiguriaHomes Casamare Real Estate in our search for a second home in Ospedaletti, Liguria. From the very beginning, Pavel demonstrated professionalism, patience, and deep knowledge of the local market. He helped us find a beautiful condo that exceeded our expectations.

The buying process, however, was far from simple. As Canadian citizens, we encountered a number of unexpected hurdles—restrictions on property ownership, challenges with opening a bank account, and the complexities of transferring funds overseas. More than once, we considered walking away from the deal.

But Pavel never wavered. He remained calm, positive, and supportive throughout every obstacle. His dedication, persistence, and problem-solving skills made all the difference. Thanks to his hard work and encouragement, we are now proud and happy owners of a beautiful second home in Liguria.

We truly can’t thank Pavel enough for everything he has done. If you’re looking to buy property in Liguria, we wholeheartedly recommend Pavel and the team at LiguriaHomes Casamare.”

Vlad and Marina